RETAIL

22 COLLEGE STREET: Asheville, NC

G/M was honored to handle the sale of one of Asheville’s venerable dining establishments, Mayfel’s Restaurant. The purchase included a 2-level commercial condominium unit with restaurant furnishings, fixtures and equipment. The restaurant features sidewalk dining opposite Pritchard Park and a charming interior courtyard in arguably the strongest retail location in downtown Asheville.

LOCATION: Asheville, NC

SALE PRICE: $1,650,000

GROSS LEASABLE AREA: 3,239 SQFT

PRICE/SQFT: $509.42

STORIES: 2

BUILT: 1936 / 2002

PARKING: 0

OCCUPANCY: 100%

ZONING: Central Business District

LAND AREA: NA (condo)

SELLER: Private individual

MAJOR TENANTS: Mayfel’s Restaurant

CLOSING ISSUES: Seller Financing / Price allocation between real estate & business / Condominium documents / Buyer reverse 1031 Exchange

25 Broadway: Asheville, NC

A unique mixed-use building in the heart of downtown Asheville with a luxury 3 bed / 2.5 bath condo unit coupled with a long-term lease to a high-end chocolatier. Sold within 3 months of listing, this was G|Ms third time selling the building within a 10-year period. There is no better compliment to our expertise than the party to the other side of a transaction later hiring us to sell their property. Investors know to maximize the value of their real estate, we are the team to hire!

LOCATION: Asheville, NC

SALE PRICE: $2,593,500

GROSS LEASABLE AREA: 7,672 SQFT

PRICE/SQFT: $338.05

STORIES: 2

BUILT: 1930 / 2011

PARKING: 2

OCCUPANCY: 67%

ZONING: Central Business District

LAND AREA: 0.06 acres

SELLER: Baldus, LTD

MAJOR TENANTS: Asheville Chocolate

CLOSING ISSUES: Tenant lease negotiation / Condo code compliance / 1031 Exchange timing

KMart Shopping Center: Asheville, NC

Eight offers were generated on this property shortly after going to market. The property sits directly across from the Asheville Mall, in the retail hub of Western North Carolina. The investment provided low risk, long-term upside, and tremendous short-term potential. Kmart was under bankruptcy protection and posted dropping sales, but its rental rate was substantially below market. The purchaser recently negotiated a lease termination with Kmart and is redeveloping the center with Whole Foods Market as the new anchor.

LOCATION: Asheville, NC

SALE PRICE: $6,900,000

GROSS LEASABLE AREA: 147,184 SQFT

PRICE/SQFT: $46.88

BUILT: 1975 & 1990

PARKING: 756 (5.1 per 1,000 SQFT)

CAP RATE: 8.55%

OCCUPANCY: 92.5%

ZONING: Regional Business District

LAND AREA: 14.47 acres

PRICE/LAND SQFT: $10.95

SELLER: Estate of Edward I. Greene

MAJOR TENANTS: Kmart / Tractor Supply Company

CLOSING ISSUES: Termination options / Purchase options / Lease restrictions / Anchor bankruptcy

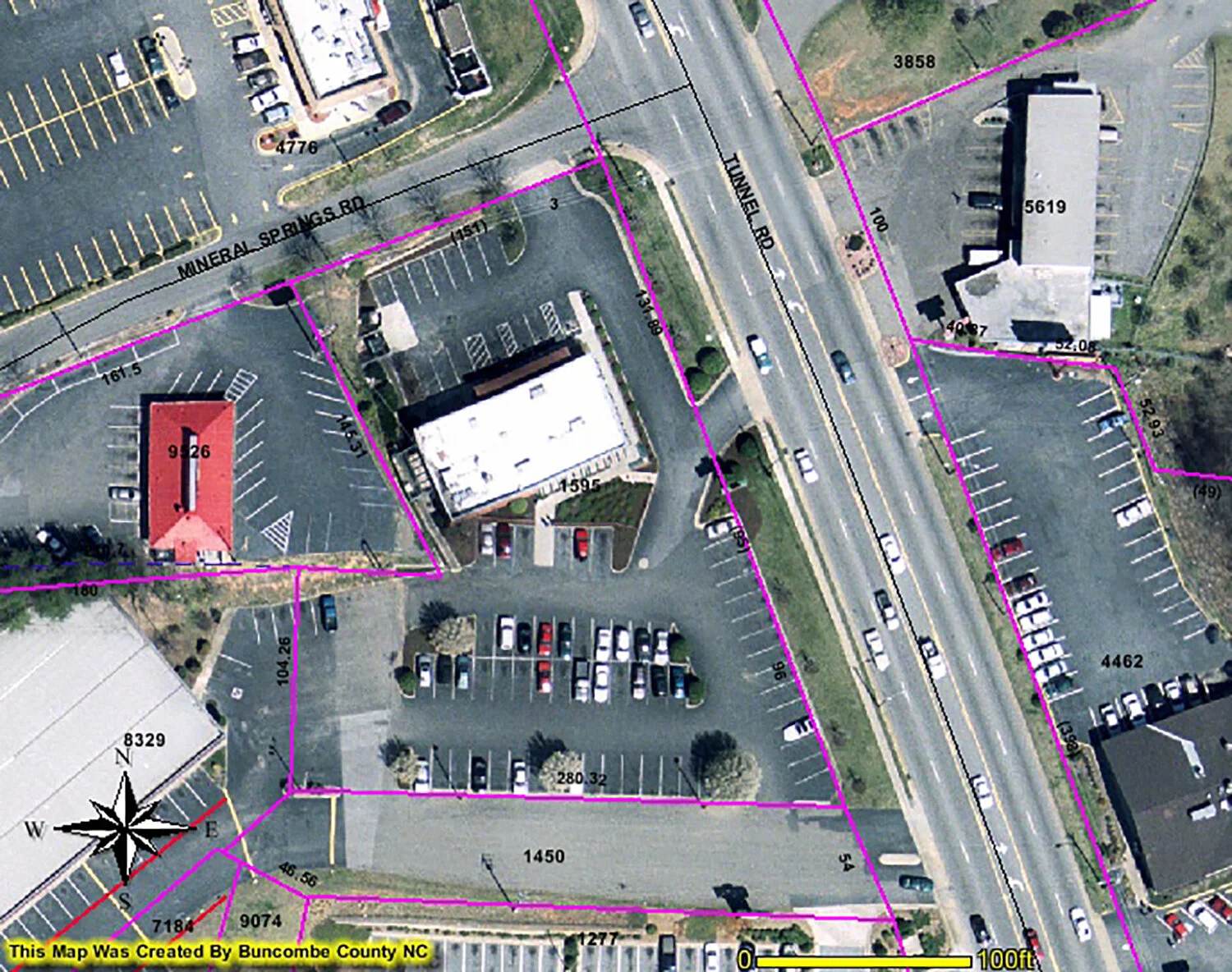

115 TUNNEL ROAD: ASHEVILLE, NC

Property was encumbered with a lease to Apple-J, LP, an Applebee’s franchisee with 18 years left on the lease. Provided Seller representation, obtaining the full asking price and the highest known sale price per square foot or per acre on Tunnel Road at time of sale (May 2007). Seller’s loan had to be assumed to avoid onerous prepayment penalty. Loan balance was only 35% of purchase price which was a marketing issue. No corporate guaranty on lease and relatively flat rental increases also presented marketing challenges. Location however was exceptional with unit sales in excess of $2.5 million per year.

LOCATION: Asheville, NC

SALE PRICE: $3,800,000

GROSS LEASABLE AREA: 4,405 SQFT

PRICE/SQFT: $862.66

BUILT: 1990

PARKING: 76 (17.2 per 1,000 SQFT)

CAP RATE: 6.7%

OCCUPANCY: 100%

ZONING: Regional Business

LAND AREA: 1.288 acres

PRICE/LAND SQFT: $67.71

SELLER: Sobhani 2005 Trust & Children

MAJOR TENANTS: Apple-J. LP

CLOSING ISSUES: Buyer assumption of seller's loan / 1031 Exchange for buyer & seller / Lease structure

MCDOWELL SQUARE: Marion, NC

Dominate grocery-anchored retail center (72,020sf) serving residents of McDowell County. Excellent visibility from US Highways 221/70/226 and shadow anchored by Lowes Home Improvement and Big Lots. Prior to going to market, G/M Property Group successfully renegotiated long-term leases with the majority of the tenancy. National chain-store tenants generated over 80% of the property’s revenue and the center was 94% leases and occupied at disposition.

Long-term leases, limited deferred maintenance and strong store sales benefitted this property and allowed G/M to generate multiple offers and transact in a seamless manner. The sellers were able to complete a 1031 exchange and repositioned into a several passive income streams with a single tenant, NNN investments.

LOCATION: Marion, NC

SALE PRICE: $7,400,000

GROSS LEASABLE AREA: 72,020 SQFT

PRICE/SQFT: $102.75

BUILT: 1991 / 1995

PARKING: 450 (6.2 per 1,000 SQFT)

CAP RATE: 8.1%

OCCUPANCY: 94%

ZONING: C-2 General Business District

LAND AREA: 13.06 acres

PRICE/LAND SQFT: $13.01

SELLER: Great Meadows, Inc.

MAJOR TENANTS: Food Lion / Peebles / CATO / Professional Vision

CLOSING ISSUES: Lease extension of major anchor tenant / New roof for 34,000SF and milling/repaving parking area / Amending of covenants, conditions, restriction agreement

668 E. MAIN STREET: Franklin, NC

Represented the buyer on a 1031 exchange acquisition during the Great Recession. The building was newly constructed and leased for 15 years to Dollar General. Located adjacent to a McDonalds at a signalized intersection serving Franklin, NC.

LOCATION: Franklin, NC

SALE PRICE: $1,140,000

GROSS LEASABLE AREA: 9,014 SQFT

PRICE/SQFT: $126.47

BUILT: 2010

PARKING: 40 (4.4 per 1,000 SQFT)

CAP RATE: 8.5%

OCCUPANCY: 100%

ZONING: AA2 Commercial

LAND AREA: 1.0 acres

PRICE/LAND SQFT: $26.17

SELLER: Franklin Real Estate Investors, LLC

MAJOR TENANTS: Dollar General

CLOSING ISSUES: 1031 Exchange- delay with buyer’s downleg property

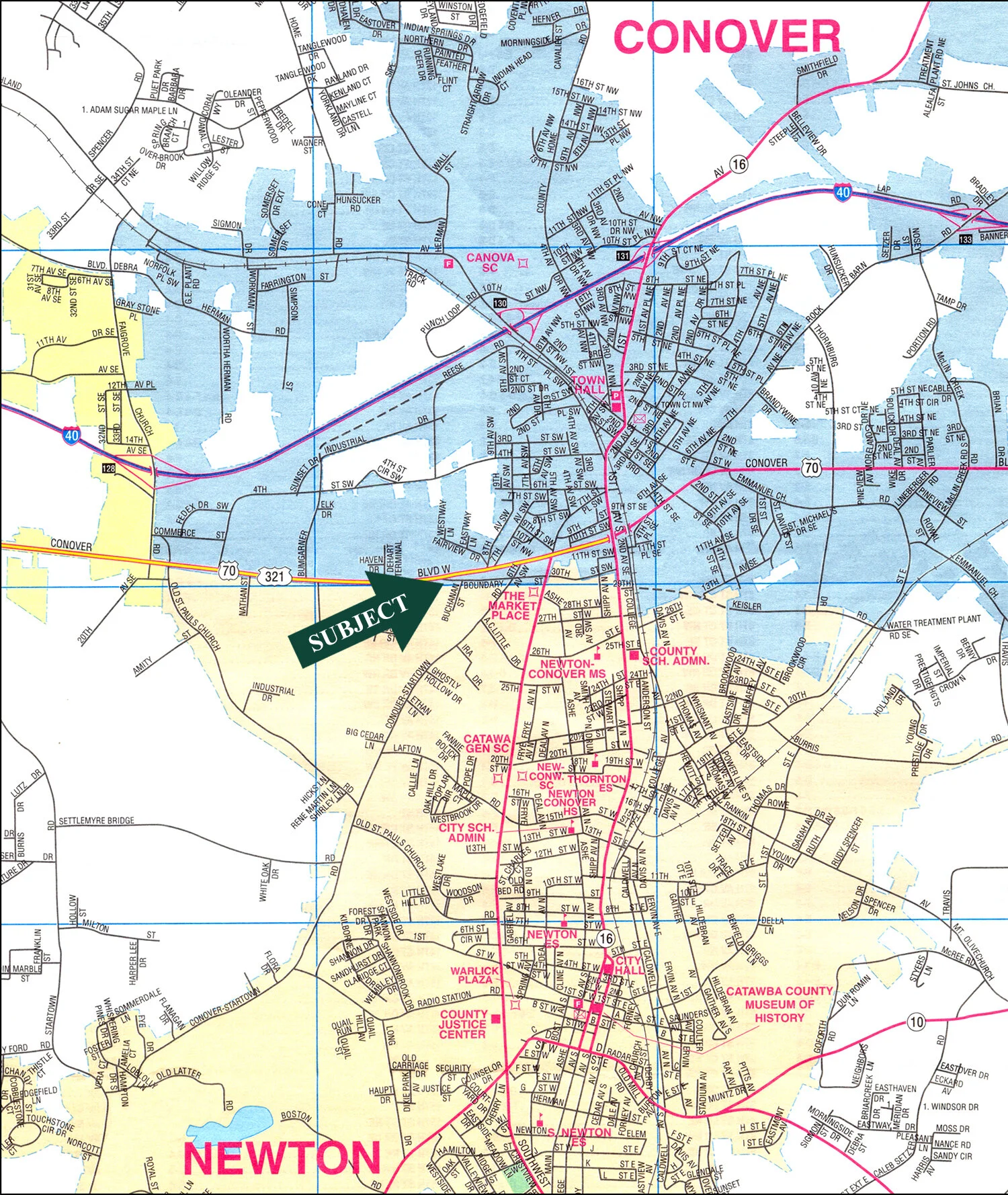

CATAWBA VILLAGE: Newton-Conover, NC

This property conveyed as part of a retail portfolio sale. It was developed as a food and drug anchored neighborhood center in 1978. Since the anchors vacated, the center languished with over 70% vacancy. Due to functional obsolescence and substantial retail growth five miles to the west surrounding the Valley Hills Mall, many retail investors/developers questioned the long-term retail viability of the property’s location. Tenants either relocating within the immediate trade area or opening new locations within the market prefer the area immediately surrounding the Valley Hills Mall. While there was interest from non-retail users/investors, a national retail owner who specializes in the acquisition and redevelopment of underperforming shopping centers ultimately purchased the center.

LOCATION: Newton-Conover, NC

SALE PRICE: $1,010,000

GROSS LEASABLE AREA: 59,950 SQFT

PRICE/SQFT: $16.85

BUILT: 1978

PARKING: 308 (5.1 per 1,000 SQFT)

OCCUPANCY: 27.9%

ZONING: Planned Development-Shopping Center-Major

LAND AREA: 9.63 acres

PRICE/LAND SQFT: $2.41

SELLER: Catawba Village (E&A), LLC

MAJOR TENANTS: None

CLOSING ISSUES: Portion of a portfolio sale

CROSSROADS PLAZA: Rocky Mount, NC

A redevelopment opportunity sold for substantially below replacement cost. Without projecting any lease-up of existing vacant space and terminating every tenant upon lease expiration, the property could maintain positive cash flow for seven years. The purchaser could implement a redevelopment plan while benefiting from positive cash flow immediately. Retail development had exploded in Rocky Mount as many new retail tenants entered the market. Unfortunately, market vacancy had also increased to over 13%. At the time of closing, Sam’s Club had contracted to purchase the former Tarrytown Mall across the street. The continuing influx of new retail tenants to the area coupled with strong regional accessibility and high traffic counts should contribute to the successful lease-up of existing vacancy and create significant upside.

LOCATION: Rocky Mount, NC

SALE PRICE: $5,975,000

GROSS LEASABLE AREA: 171,460 SQFT

PRICE/SQFT: $34.56

BUILT: 1970-1986

PARKING: 864 (5.0 per 1,000 SQFT)

CAP RATE: 9.3%

OCCUPANCY: 67.25%

ZONING: B-2 Highway Commercial Business District)

LAND AREA: 24.18 acres / Additional undeveloped 29.67 acres

PRICE/LAND SQFT: $5.63

SELLER: Estate of Edward I. Greene

MAJOR TENANTS: West Corporation (Super Value)

CLOSING ISSUES: Non-retail anchor / Short-term rollover

RAEFORD-HOKE VILLAGE: Raeford, NC

Excellent opportunity to acquire a modern neighborhood shopping center that was 100% leased to national and regional chain-store tenants in a growing residential community with low retail vacancy. This was the dominant grocery anchored neighborhood center in western Hoke County, with only one competitive center located on the eastern boundary of a 5-mile radius. The retail vacancy rate within 12 miles of the Property was less than one percent. The same tenants had occupied 100% of the Property for 10 or more years. The scarcity of retail space in the market and accelerating residential growth should contribute to minimal vacancies, escalating rental rates and strong tenant sales growth at the Property in the near future.

LOCATION: Raeford, NC

SALE PRICE: $3,200,000

GROSS LEASABLE AREA: 73,530 SQFT

PRICE/SQFT: $51.00

BUILT: 1979

PARKING: 346 (4.7 per 1,000 SQFT)

CAP RATE: 9.83%

OCCUPANCY: 100%

ZONING: Highway Commercial (HC)

LAND AREA: 8.76 acres

PRICE/LAND SQFT: $9.38

SELLER: E&A Properties LP

MAJOR TENANTS: Food Lion / CVS Pharmacy

CLOSING ISSUES: In-line CVS / M-T-M tenants / Short-term leases / Tenant sales

KMART: Waynesville, NC

Nine offers were generated on this property. Initially interest in this investment was low due to the small market size and lack of available financing (Kmart was still under bankruptcy protection). In addition, Kmart’s rent was at or above market, and the investment community was concerned about the ability to attract another large tenant to Waynesville. The loss of Kmart would increase overall retail vacancy in the market from less than one percent to over 11%. However, once Kmart emerged from bankruptcy protection and its credit improved, interest in the property soared as financing once again became available. The property went under contract just as Kmart announced its acquisition of Sears. The transaction closed shortly thereafter.

LOCATION: Waynesville, NC

SALE PRICE: $6,850,000

GROSS LEASABLE AREA: 137,914 SQFT

PRICE/SQFT: $49.67

BUILT: 1987-1989

PARKING: 608 (4.4 per 1,000 SQFT)

CAP RATE: 10.62%

OCCUPANCY: 100%

ZONING: Commercial District

LAND AREA: 16.71 acres

PRICE/LAND SQFT: $9.41

SELLER: G&T Developers

MAJOR TENANTS: Kmart / Big Lots / Advance Auto

CLOSING ISSUES: Anchor credit (post-bankruptcy) / Lease restrictions / Kmart-Sears merger

2 NEW HAW CREEK LANE: Asheville, NC

With an unsurpassed location across from the Asheville Mall in conjunction with new 10-year leases, 2 New Haw Creek Lane attracted investors from across the United States. Following a call for offers, G/M Property Group selected a 1031 buyer from Minneapolis that was seeking a management free, income-producing property. Despite the strong dynamics of the property, issues related to shared parking, access and lease termination rights yielded an above market cap rate for the buyer.

LOCATION: Asheville, NC

SALE PRICE: $3,100,000

GROSS LEASABLE AREA: 9,000 SQFT

PRICE/SQFT: $344.44

BUILT: 1998

PARKING: 44 (4.9 per 1,000 SQFT)

CAP RATE: 7.4%

OCCUPANCY: 100%

ZONING: Highway Business

LAND AREA: 0.68 acres

PRICE/LAND SQFT: $104.66

SELLER: Searles Land Co., LLC

MAJOR TENANTS: Men’s Wearhouse, Inc. / Visionworks, Inc. / The Lamar Companies

CLOSING ISSUES: Cross easement parking agreement / Visonworks, Inc. termination option

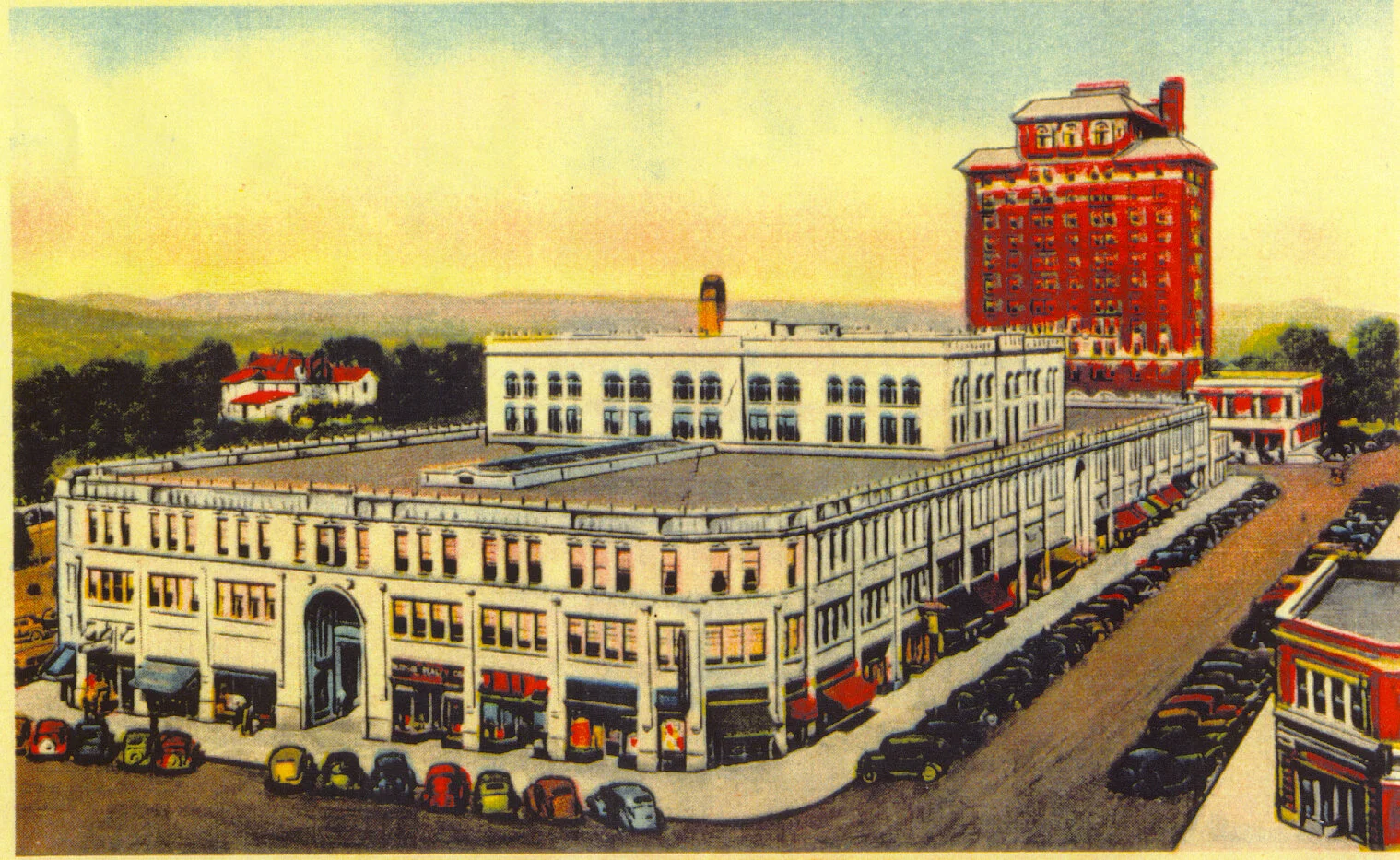

GROVE ARCADE PUBLIC MARKET: Asheville, NC

The historic Grove Arcade Public Market is one of the Southeast's most celebrated mixed-use buildings. Originally constructed in 1929, this 269,000 square foot building underwent an extensive $30 million renovation in 2002. The ground floor contains 53 retail spaces within approximately 60,000 square feet, showcasing some of Western North Carolina's premier restaurants, galleries and crafts. The upper floors contain offices and luxury apartments. The Grove Arcade is a celebration of the culture and heritage of the mountains.

We are proud to have exclusively represented the owners in the retail leasing of this historic property when it first reopened to the public in 2002.

LOCATION: Asheville, NC

GROSS LEASABLE AREA: 60,000 SQFT (1st floor retail only)

STORIES: 5

BUILT: 1929

PARKING: Below grade

LANDLORD: Grove Arcade Restoration, LLC

MAJOR TENANTS:

Battery Park Book Exchange & Champagne Bar / Carmel’s Kitchen & Bar / Chorizo / Four Corners Home / Mission at the Grove / Modesto / Mountain Made / Thai Tara

FRENCH BROAD CHOCOLATE LOUNGE: Asheville, NC

What do the Biltmore Estate, the Great Smoky Mountain National Park and the French Broad Chocolate Lounge (FBCL) have in common one may ask? All are on the must-see list for the millions of tourists visiting Asheville annually. Growing from a tiny factory on the edge of downtown Asheville and with soaring popularity, it became apparent the FBCL was in need of a prime retail location. G/M is proud to have played an important role in the evolution of one of Asheville’s most notable entrepreneurial stories. With a long-term lease in arguably the best retail corner in all of downtown, FBCL is poised for massive growth as it targets markets both national and international.

The explosive growth later included the need for a local factory to handle producing over 50 tons of chocolate each year. G/M negotiated the expansion to the Ramp Studios, a 14,000 square foot state of the art facility that includes production, retail and chocolate tours to their adoring chocolate fans from around the world.

LOCATION: Asheville, NC

GROSS LEASABLE AREA: 4,167 SQFT

BUILT: 1929

TENANT: French Broad Chocolate Lounge

LANDLORD: Pack Square Investors II, LLC