OFFICE / MIXED-USE / MEDICAL

20 artful way: asheville, nc

Radview is a dynamic place for people to fully inhabit the River Arts District. Twenty-six studio apartments with southwestern views are perched on the 3rd and 4th floors. The 2nd floor offers an eclectic mix of creative office space while street level storefronts deliver much needed studio, gallery and retail space. Developed, designed, built and owned by locals for locals. Activating the building 24/7 infuses a robust, innovative energy of people living, working, creating and playing in the River Arts District.

PROJECT NAME: RADVIEW

TYPE: Mixed-use development

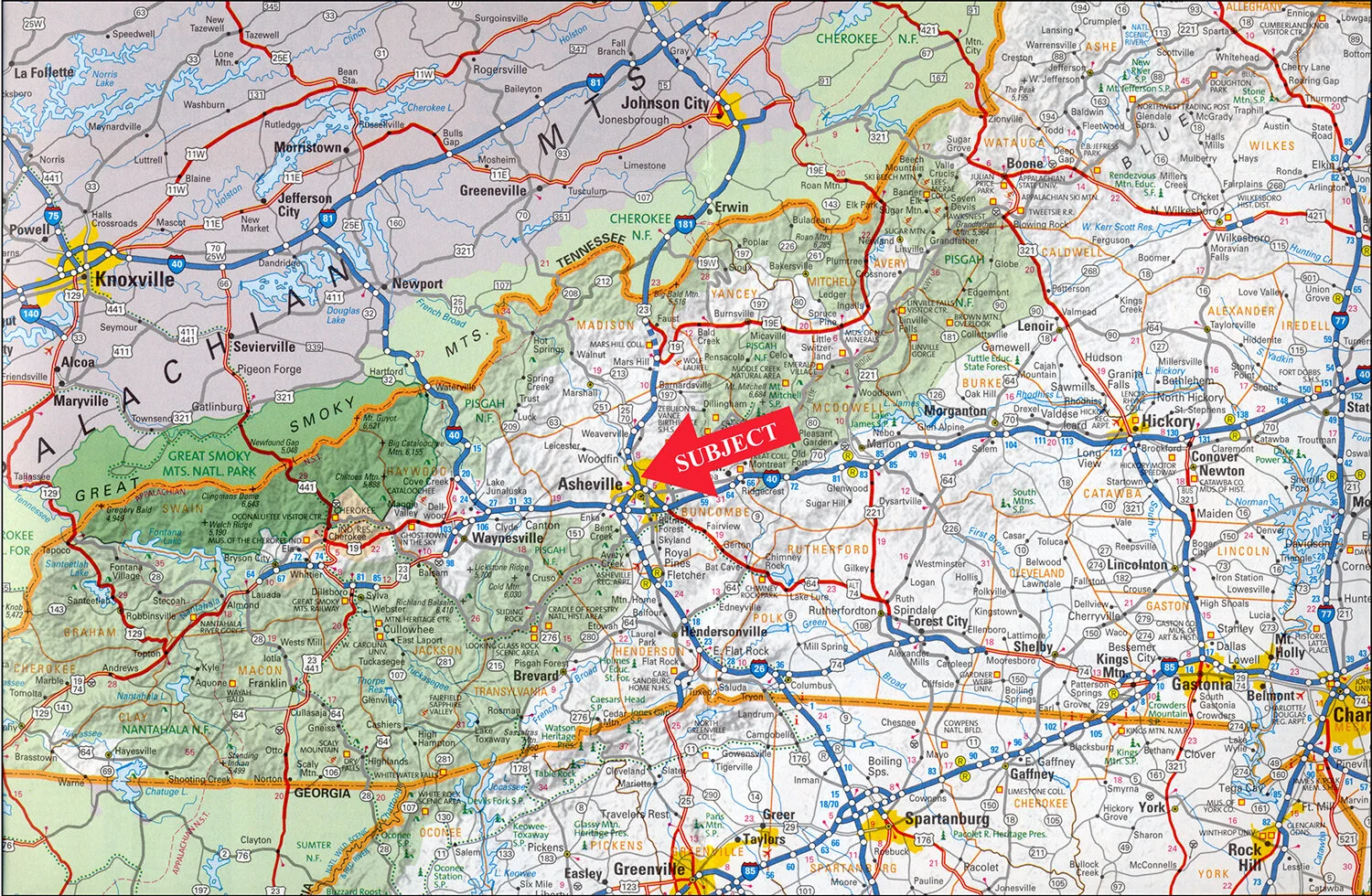

LOCATION: Asheville, NC

GROSS LEASABLE AREA: 18,728 SQFT

STORIES: 4

BUILT: 2021

PARKING: 22

ZONING: RAD-NT

LAND AREA: 0.47 acres

DEVELOPER: Jeremy Goldstein

MAJOR TENANTS: G/M Property Group, LLC / There There Shop, LLC

PROPERTY SUMMARY: Opportunity zone development / Groundbreaking: 03/2/2020 / Commercial space opened 11/2021 / Apartments opened 03/2022

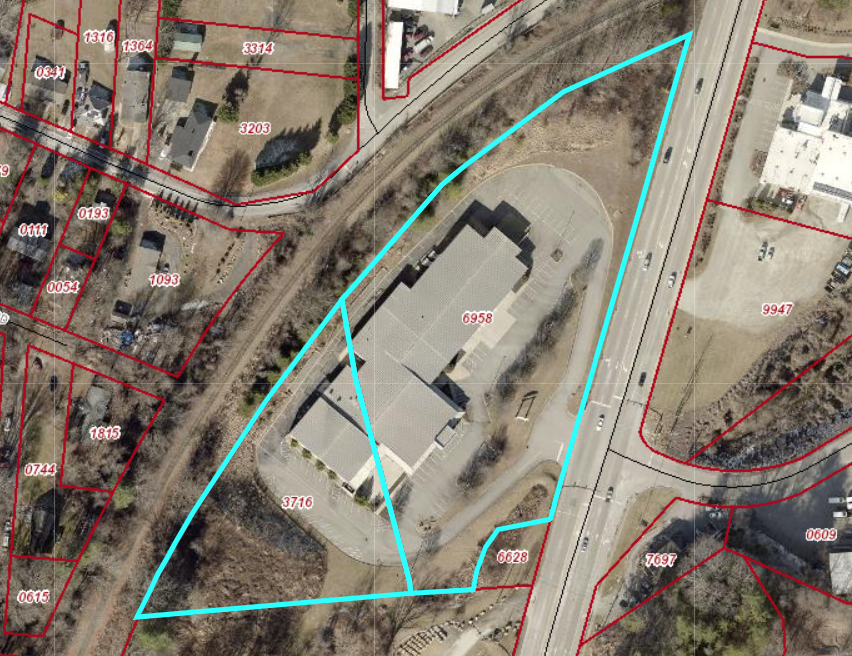

TRI-CENTURY EYE CARE, PC: SOUTHAMPTON, PA

Tri-Century Eye (TCE) has been the dominant eye care provider in the Philadelphia, PA metro area for nearly 50 years. In order to best position TCE for continued success and growth well into the future, G/M Property Group was chosen from amongst several large national companies to assist in the sale, and leaseback, of TCE's flagship location with accredited surgery center. The assignment included structuring an absolute triple net lease, providing counsel and assistance during a mid-deal corporate restructuring and navigating a nationwide marketing campaign through the COVID-19 pandemic. G/M's savvy and persistence resulted in a closing price that shattered the all-time medical office building sales price per square foot record in Bucks County, Pennsylvania.

LOCATION: Southampton, PA

SALE PRICE: $8,350,000

GROSS LEASABLE AREA: 20,199 SQFT

PRICE/SQFT: $413.39

STORIES: 2

BUILT: 1983 / 1985 / 2005

PARKING: 79 (4.0 per 1,000 SQFT)

CAP RATE: 6.7%

OCCUPANCY: 100%

ZONING: Retail Service District

LAND AREA: 2.26 acres

SELLER: Second Street Pike Partners, LLC

MAJOR TENANTS: Tri-Century Eye Care, PC

CLOSING ISSUES: COVID-19 / Corporate restructuring / Lease negotiation

291 SWEETEN CREEK ROAD: Asheville, NC

Digestive Health Partners, PA (DHP), the premier gastroenterological practice serving Western North Carolina, engaged G/M Property Group to handle their search for a new facility. Following a yearlong effort, G/M sourced an off-market building that was ideal for medical redevelopment.

The 1-story building was formerly built for a local newspaper, the Iwanna, and later converted to a conference/event center. Situated under a mile from I-40, the location is ideal for DHP to serve patients across the region. The redeveloped building represents a 60% increase over their former location.

LOCATION: Asheville, NC

SALE PRICE: $7,000,000

GROSS LEASABLE AREA: 40,395 SQFT

PRICE/SQFT: $173.28

STORIES: 1

BUILT: 1998

PARKING: 128 (3.2 per 1,000 SQFT prior to redevelopment)

OCCUPANCY: 0%

ZONING: Commercial Industrial

LAND AREA: 7.71 acres

SELLER: SGH/DJS, LLC

MAJOR TENANTS: NA

CLOSING ISSUES: Lender’s Appraisal / Financing /Compressed Inspection Schedule

3 McDowell Street: Asheville, NC

G/M Property Group, LLC crafted a 10-year sale / leaseback for Keystone Lab’s downtown Asheville facility. Built in 1908, prior uses included automotive & truck repair and underground storage of petroleum products. Despite having to navigate a host of issues, the transaction closed in less than 4.5 months from listing date. Buyer was an out-of-state 1031 exchange investor, demonstrating once again Asheville's appeal to national investors, and G/M’s ability to market investments nationwide.

LOCATION: Asheville, NC

SALE PRICE: $3,500,000

GROSS LEASABLE AREA: 15,202 SQFT

PRICE/SQFT: $230.23

STORIES: 1

BUILT: 1908-1915 / 1998

PARKING: 55 (3.6 per 1,000 SQFT)

CAP RATE: 7.7%

OCCUPANCY: 100%

ZONING: Office Business

LAND AREA: 1.5 acres

SELLER: Keystone Investors

MAJOR TENANTS: Keystone Laboratories, LLC / Wolfe & Associates, Inc. / DePaolo Orthopedics

CLOSING ISSUES: Leaseback terms / Environmental contamination / Underground stream

14 O'Henry Avenue: Asheville, NC

Twenty Lake Holdings based in New York City had a portfolio of Gannett newspaper properties under contract, including 14 O’Henry Avenue, the headquarters for the Asheville Citizen Times since 1939. Following a competitive selection process, G/M Property Group, LLC was tasked with the challenge of securing a buyer to close on the property simultaneously with Twenty Lake Holdings’ portfolio acquisition from Gannett. Further complicating the process was the high level of confidentiality required during marketing, with Twenty Lake Holdings not wishing to disclose their asking price while negotiating their Gannett transaction. Despite limited online presence and restricted marketing we successfully brokered the closing within five months of listing. Closing issues included negotiating the leaseback terms between the Gannett, Twenty Lake Holdings and the eventual buyer.

LOCATION: Asheville, NC

SALE PRICE: $5,250,000

GROSS LEASABLE AREA: 64,527 SQFT

- 17,491 sqft finished basement

- 9,622 sqft above grade industrial

- 37,414 sqft office space

PRICE/SQFT: $81.36 including basement

BUILT: 1939

PARKING: 17

CAP RATE: Confidential

OCCUPANCY: 33%

ZONING: Central Business District

LAND AREA: 0.60 acres

SELLER: Gannett Co., Inc. / Twenty Lake Holdings

MAJOR TENANTS: Gannett Co., Inc dba Asheville Citizen-Times

CLOSING ISSUES: Code analysis – from single tenant to multi-tenant use / Seller leaseback terms / Concurrent purchase / Sale by buyer

Asheville Eye Associates: Western North Carolina

Asheville Eye Associates (AEA) is a market-leading eye care center with a 60-year history providing eye care treatment to residents of Western North Carolina. Following a competitive selection process, AEA hired G/M Property Group, LLC to handle the sale/leaseback of their regional portfolio. As part of the group’s long term strategic planning, we negotiated new 15-year net leases for each property and performed all financial underwriting as part of our marketing process. Our nationwide marketing platform yielded multiple offers from investors across the United States.

LOCATION: Asheville, NC / Hendersonville, NC / Sylva, NC

SALE PRICE: $30,000,000

GROSS LEASABLE AREA: 70,060 SQFT

PRICE/SQFT: $428.20

STORIES: 1-2 story buildings

BUILT: 1979-2016

PARKING: 390 (5.6 per 1,000 SQFT)

CAP RATE: Confidential – asking 5.75%

OCCUPANCY: 100%

ZONING: Commercial

LAND AREA: 10.77 acres

SELLER: Asheville Eye Associates

MAJOR TENANTS: Asheville Eye Associates

CLOSING ISSUES: Seller leaseback terms / Seller lease guarantees / Tenant expansion rights / Title objections / Property price allocations

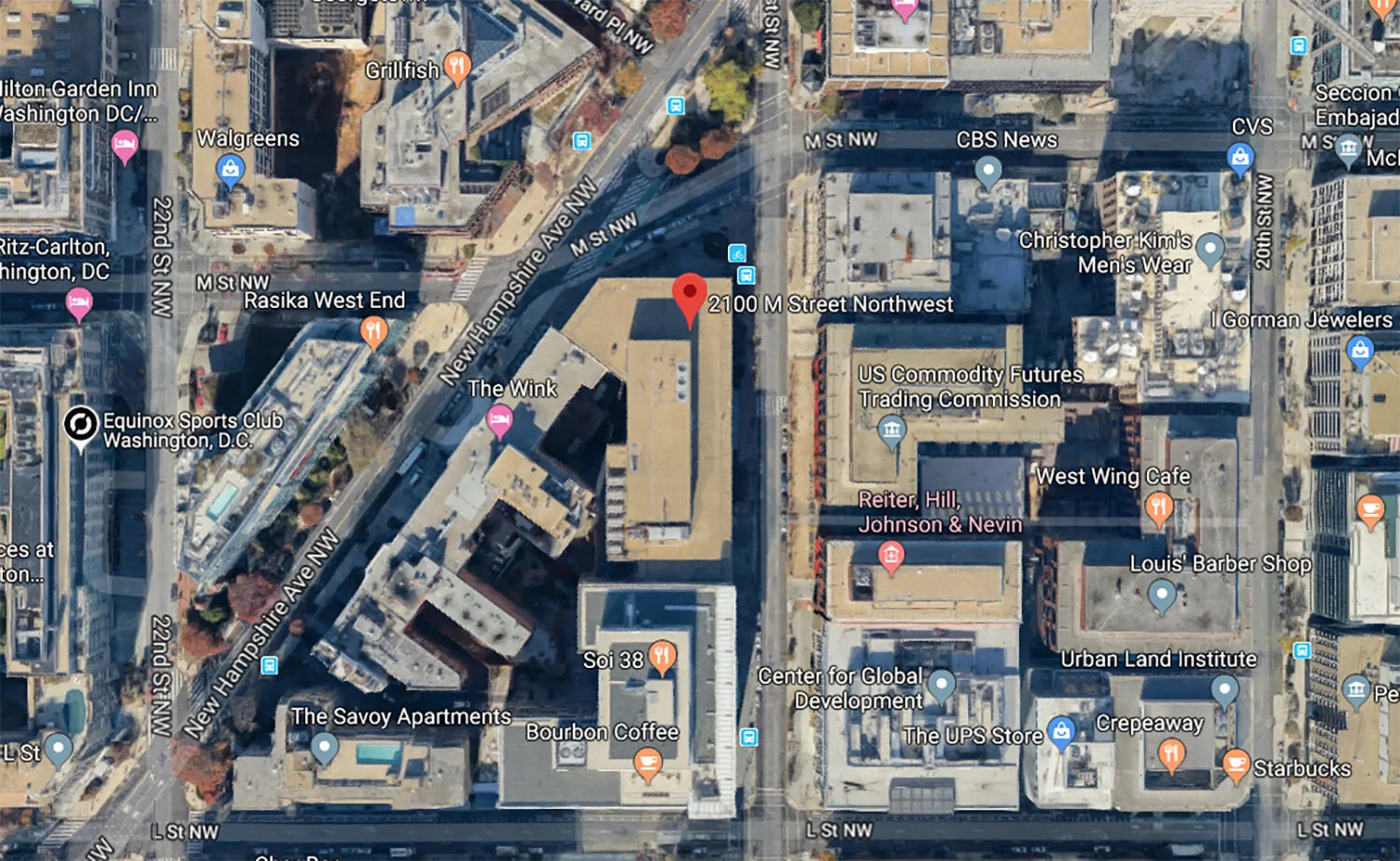

2100 M Street NW: Washington DC

Identified, underwrote and was an integral part of negotiations for the purchase of 2100 M Street. Pending expirations represented upside through below market rents. Buyer implemented a successful renovation program and subsequently sold the property for $56.6 million after a 3-year hold.

LOCATION: Washington, DC

SALE PRICE: $35,000,000

GROSS LEASABLE AREA: 298,067 SQFT

PRICE/SQFT: $117.42

STORIES: 8

BUILT: 1969

TYPICAL FLOOR: 34,855 rentable SQFT

PARKING: Below-grade parking for 213 vehicles

SELLER: Charles E. Smith Company

MAJOR TENANTS: Urban Institute / FCC / George Washington University

CLOSING ISSUES: GSA leases with right to terminate clauses / Deferred maintenance

310 Overlook Road: Fletcher, NC

Originally constructed for pre-school childcare, the long time tenant decided to vacate the building. Representing the Noburn Family Estate, we navigated code issues associated with the buyer’s goal to convert the property from childcare to traditional office space.

LOCATION: Fletcher, NC

SALE PRICE: $720,000

GROSS LEASABLE AREA: 5,300 SQFT

PRICE/SQFT: $135.58

BUILT: 1991

OCCUPANCY: 0%

ZONING: Institutional District

LAND AREA: 0.77 acres

SELLER: Wachovia Bank Trustee for Noburn Family

MAJOR TENANTS: La Petite Academy

CLOSING ISSUES: Zoning / Build code upgrade

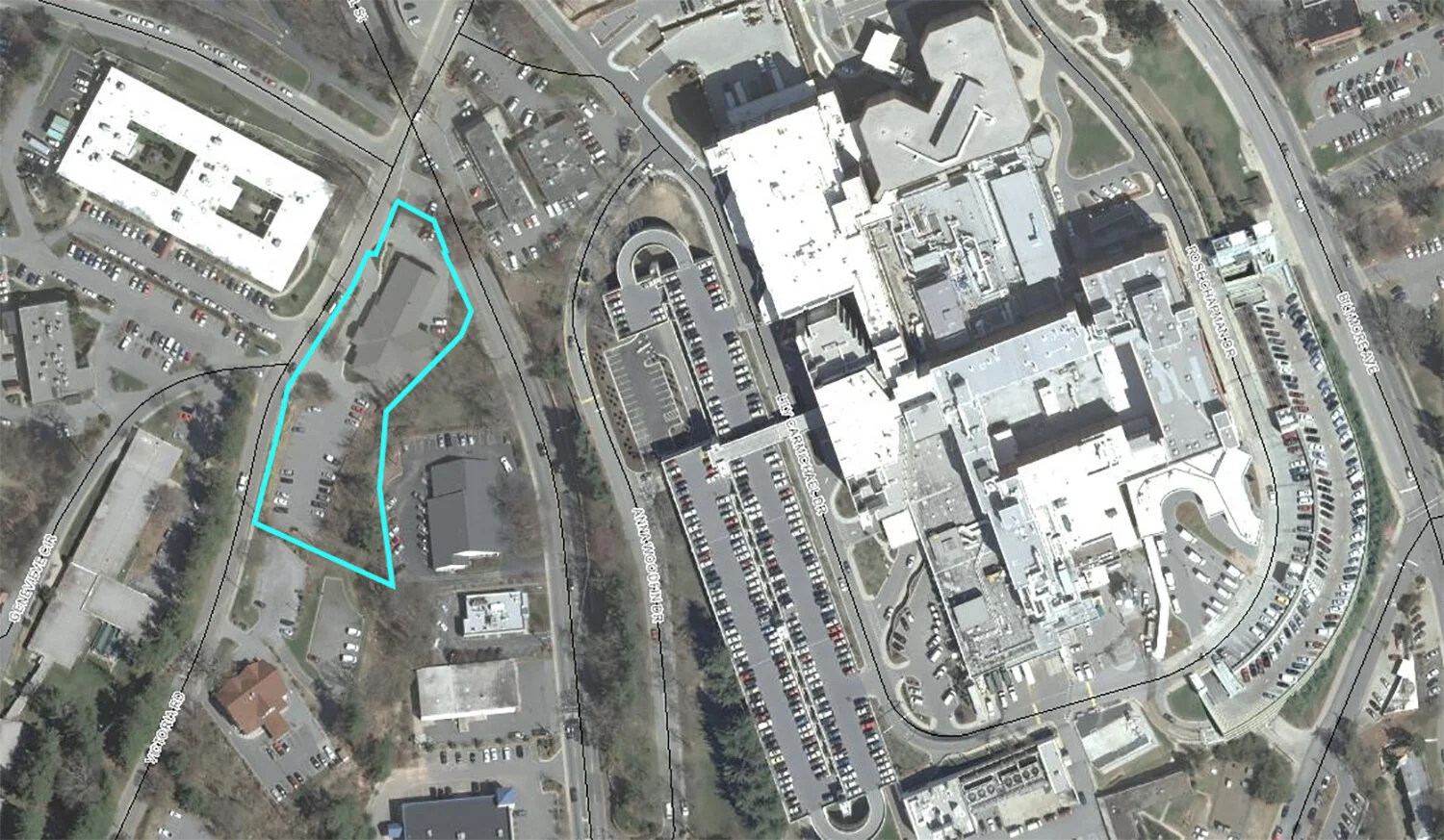

2810 Parham Road: Richmond, VA

First Union (63,747 sf) was vacating this operations center due to mergers with two banks that each completed brand new state-of-the-art facilities in the Richmond market prior to their mergers with First Union. The acquisition cost of this investment was approximately 60% of replacement cost. The purchaser viewed lease-up of the First Union space as significant upside potential in a market with little vacancy, escalating market rental rates, and very few large blocks of existing space for lease. The purchaser planned to further increase return on investment by converting covered parking to office rental space. Purchaser was based out of Boston, MA.

LOCATION: Richmond, VA

SALE PRICE: $11,650,000

GROSS LEASABLE AREA: 146,000 SQFT

PRICE/SQFT: $79.79

CAP RATE: 13.1% on projected stabilized NOI

OCCUPANCY: 100% upon sale / 56.34 % after First Union vacates

LAND AREA: 9.932 acres

SELLER: First Union Bank

CLOSING ISSUES: UST (leaking & removal) / Contract Execution (timing) / Bank of America expense stop / Utility easement (non-contingent) / Bank of America estoppel certificate

63 Monticello Road: Weaverville, NC

In 2017, Mission Health entered into an agreement to purchase Weaverville Family Medical Associates, a family medical practice serving north Asheville. G/M Property Group, LLC was hired to negotiate a new 10-year NNN lease on behalf of four doctors that retained ownership of the real estate post-merger. Subsequently, in early 2018 G/M negotiated the property's sale to a 3rd party investor backed by the credit of Mission Health and the triple net lease.

In 2019, Mission Health was acquired by HCA Healthcare in a $1.5 billion transaction. Recognizing the improved credit strength of the new tenancy in conjunction with a booming economy and low interest rate environment, the landlord hired G/M to sell the property in the fall of 2019. Despite just 7 years remaining on the lease and unthinkable turmoil amidst the COVID-19 pandemic, G/M handled the sale in approximately 6 months from engagement. Seller recognized an 18% gain on the sale over a ~ 2-year hold. Buyer was the economic development organization to the members of the Eastern Band of Cherokee Indians

LOCATION: Weaverville, NC

SALE PRICE: $3,300,000

GROSS LEASABLE AREA: 14,159 SQFT

PRICE/SQFT: $233.07

STORIES: 2

BUILT: 1982 / 1987 / 1999

PARKING: 202 (14.3 per 1,000 SQFT)

CAP RATE: 7.4%

OCCUPANCY: 100%

ZONING: Residential R-3

LAND AREA: 7.81 acres

SELLER: Ashley Furniture Square, LLC

MAJOR TENANTS: HCA Healthcare

CLOSING ISSUES: Title issue affecting buyer / Environmental (1980s construction materials) / COVID-19 pandemic / National riots

100 Victoria: Asheville, NC

G/M Property Group, LLC represented the Buyer seeking a 1031 exchange investment. The property is situated directly across from Mission Hospital, the flagship medical center serving Western North Carolina. Occupied by Victoria Urological Associates / Mission Hospital, the initial 10-year lease term had 5.5 years remaining at closing. This off-market deal successfully secured for the Buyer a low-risk, long-term investment in Asheville’s premier medical hub.

LOCATION: Asheville, NC

SALE PRICE: $3,605,000

GROSS LEASABLE AREA: 13,769 SQFT

PRICE/SQFT: $261.82

STORIES: 2

BUILT: 1969

PARKING: 41 (3.0 per 1,000 SQFT)

CAP RATE: 7.2%

OCCUPANCY: 100%

ZONING: Institutional

LAND AREA: 1.3 acres

SELLER: Victoria Urological Associates Properties, LLC

MAJOR TENANTS: Mission Hospital, Inc.

CLOSING ISSUES: Deferred maintenance / Shared retaining wall responsibilities / Title / Encroachment

48 Grove Street #200: Asheville, NC

A second floor office condominium, the property had been occupied for over 50 years by the NC Employment Securities Commission. Despite this longevity, the creditworthiness of the state tenancy was greatly diminished by the risk of a single tenant condominium with only two years remaining on the in-place 5-year lease term and the tenant’s right to terminate at any time with 60 days notice. By negotiating a significant escrow deposit held for several years post closing, we were successful in overcoming these challenges for the seller.

LOCATION: Asheville, NC

SALE PRICE: $2,050,000

GROSS LEASABLE AREA: 13,580 SQFT

PRICE/SQFT: $150.96

STORIES: 2

BUILT: 1970

PARKING: Paved, on-site

CAP RATE: 7.75%

OCCUPANCY: 100%

ZONING: Central Business District

LAND AREA: 2.14 acres

SELLER: BOC Enterprises of Asheville, LLC

MAJOR TENANTS: State of North Carolina

CLOSING ISSUES: Lease termination right

21 Battery Park #201: Asheville, NC

Achieving one of the highest sale prices per square foot in downtown Asheville, G/M Property Group, LLC proudly represented a prominent law firm in the sale of their office condominium. 21 Battery Park is one of the most sought after mixed-use buildings in the heart of downtown Asheville offering luxury residential condos, 2nd floor office, street-level retail and structured parking.

LOCATION: Asheville, NC

SALE PRICE: $700,000

GROSS LEASABLE AREA: 2,100 SQFT

PRICE/SQFT: $333.33

STORIES: 7

BUILT: 2006

PARKING: 2

OCCUPANCY: 0%

ZONING: Central Business District

LAND AREA: NA (condominuim)

SELLER: Secondfloor, LLC

MAJOR TENANTS: NA

CLOSING ISSUES: Pending HOA assessment

90 ZILLICOA: Asheville, NC

90 Zillicoa St. was originally designed for medical use and converted to a preschool day care facility. The property is located in a mixed-use subdivision with restrictions on uses and building modifications. The buyer was a private elementary school, an ideal use for the 27,000 square foot building, which included tennis courts, a swimming pool and acreage for playgrounds.

LOCATION: Asheville, NC

SALE PRICE: $2,700,000

GROSS LEASABLE AREA: 26,779 SQFT

PRICE/SQFT: $100.83

STORIES: 1 plus daylight basement

BUILT: 1967

PARKING: 40 (1.5 per 1,000 SQFT)

OCCUPANCY: 0%

ZONING: Institutional District

LAND AREA: 5.96

PRICE/LAND SQFT: $10.40

SELLER: Wein, LLC (Little Beaver Daycare)

MAJOR TENANTS: NA

CLOSING ISSUES: Short term seller leaseback post-closing / Shared use during leaseback

191 Biltmore avenue: Asheville, NC

Digestive Health Partners (DHP) is the largest medical practice in Western North Carolina specializing in the spectrum of clinical gastroenterology and hepatology. After decades of growth the practice had outgrown the facility at 191 Biltmore Avenue. G/M represented DHP in both the sale of their building as well as the acquisition of the replacement property. Buyer plans an extensive redevelopment of the property for Novant Health which had entered into a long-term lease agreement prior to closing. Selling price was adjusted by approximately $300,000 to offset the buyer’s NC Brownfields Agreement due to environmental contamination.

LOCATION: Asheville, NC

SALE PRICE: $6,795,000

GROSS LEASABLE AREA: 26,125 SQFT

PRICE/SQFT: $260.10

STORIES: 2

BUILT: 1991

PARKING: 148 (5.7 per 1,000)

CAP RAGE: NA

OCCUPANCY: 100%

ZONING: Central Business District

LAND AREA: 2.34 acres

SELLER: Entero-Med, LLC

MAJOR TENANTS: Digestive Health Partners

CLOSING ISSUES: Environmental Brownfield Agreement Negotiation